Attention entrepreneurs tired of bank rejections

Discover How To Secure Up To $100K In Business Funding In The Next 90 Days Without Perfect Credit Or Collateral

Finally uncover what is stopping you from unlocking the capital you deserve

Transform Your Finances With The Credit to Funding Mentorship

A start to finish system that makes lenders say yes

Designed for hard working founders earning income yet blocked by low scores

Picture confidently swiping a new business card that funds inventory marketing and growth

Personalized credit repair action plan

Live mentorship and accountability

Proven funding application scripts

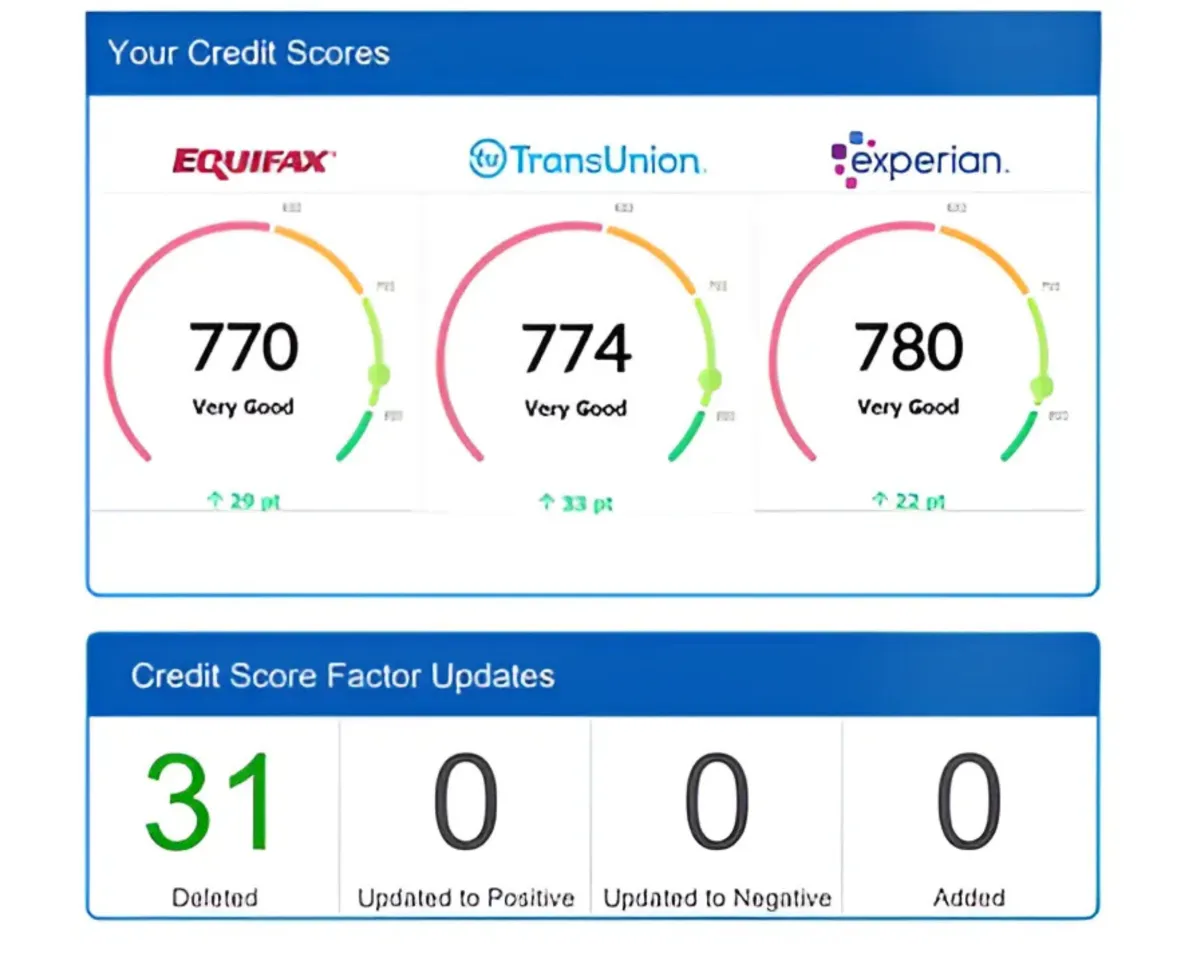

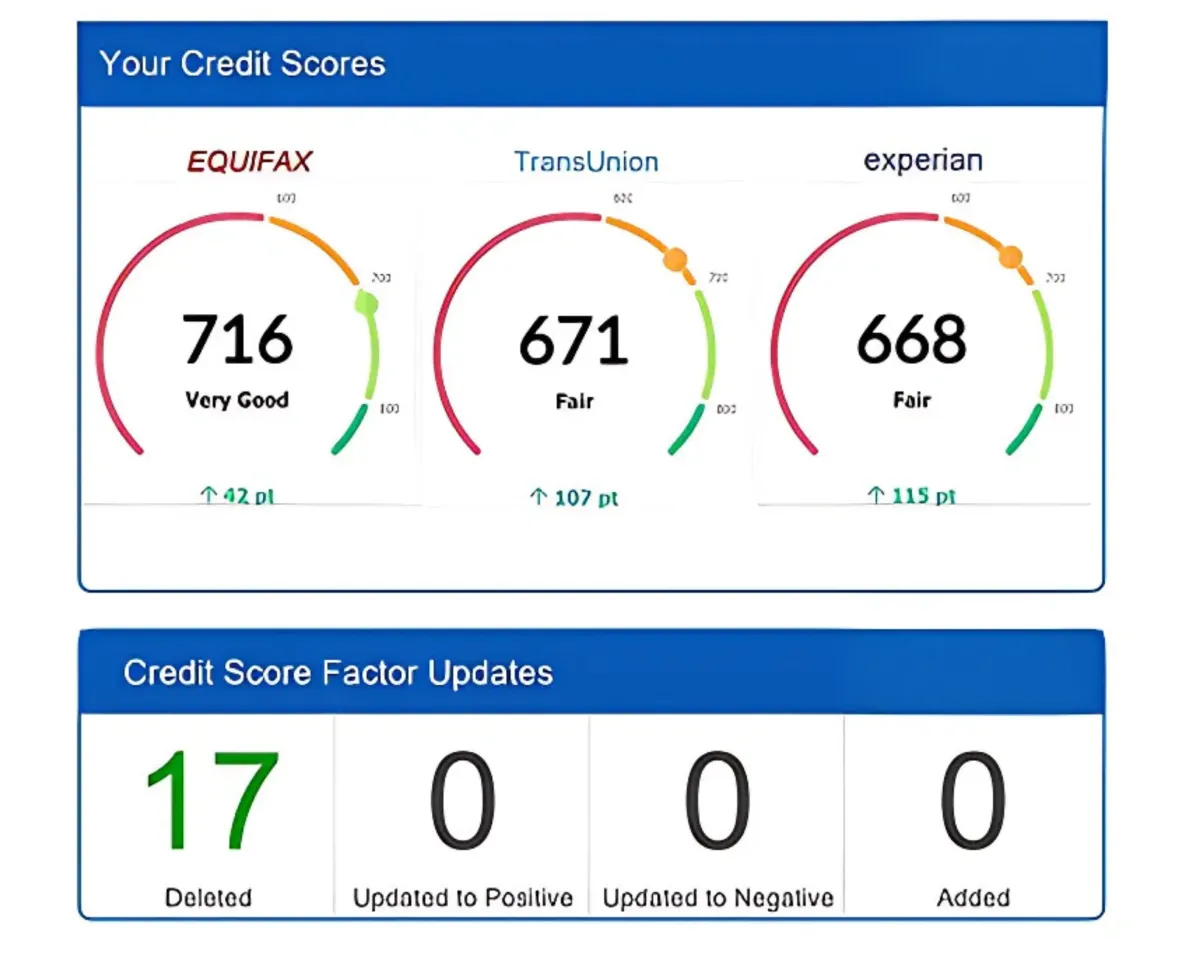

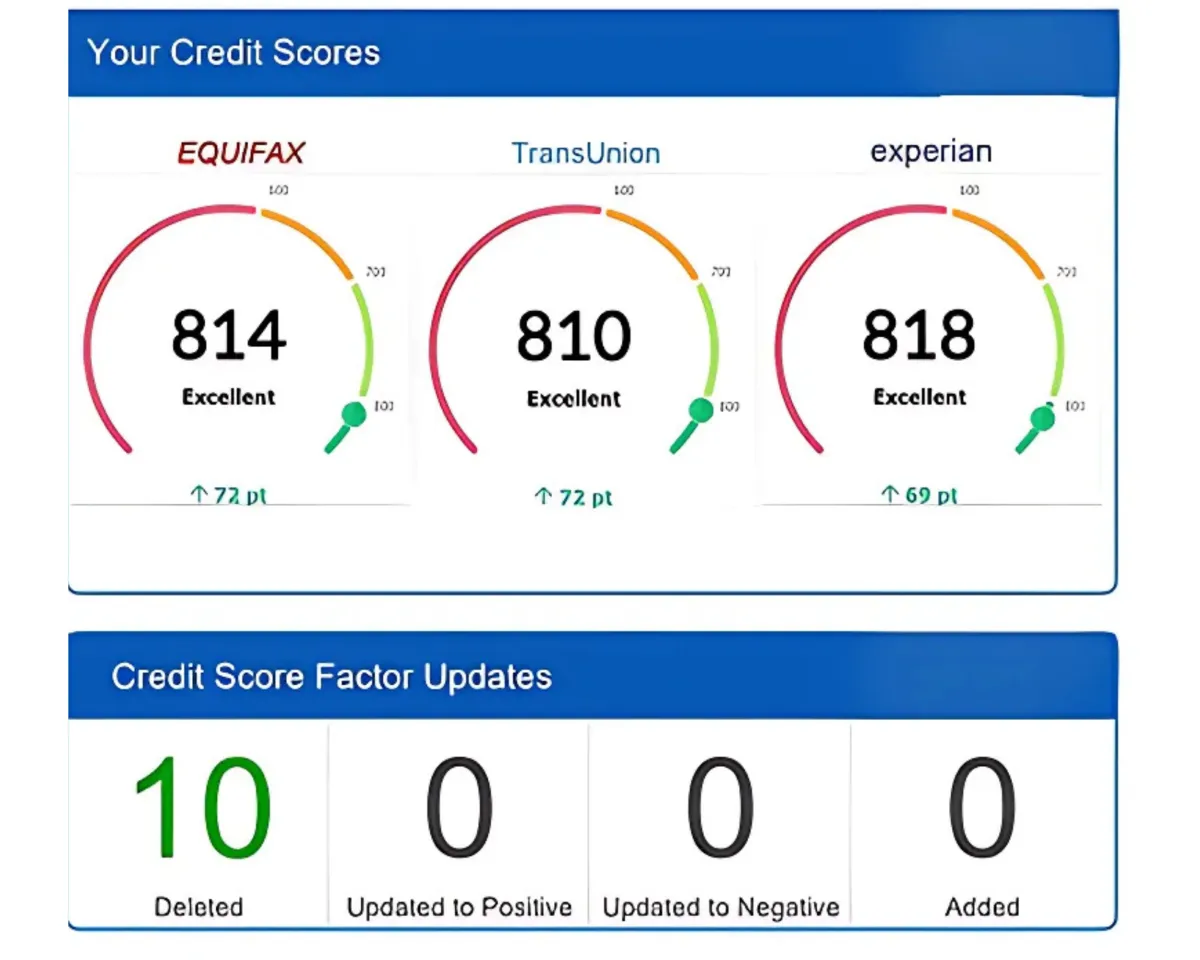

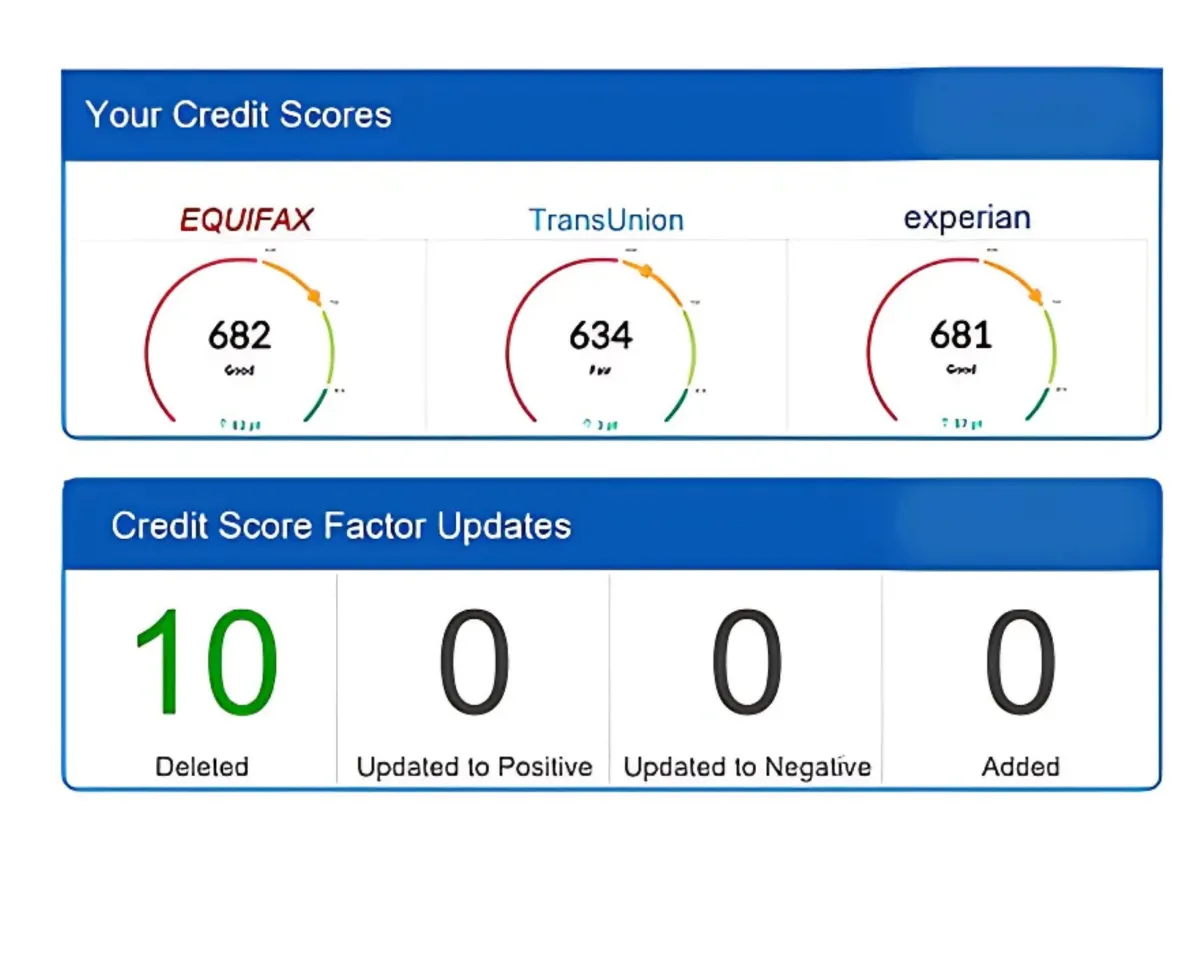

Cr8tive Financial Group have raised over four million dollars in unsecured funding while increasing average FICO scores by 112 points

Ready to become fundable?

Trusted by 300+ . 100% risk-free.

What People Are Saying About Our Jaw-Droppingly Good Service

“We secured 60K at five percent APR and opened our second location.”

-Marcus K.

“Banks laughed at my 540 now I am at 701 and approved for 35K.”

-Priya D.

“Credit repair services alone never taught strategy. This mentorship got me 22K in fourteen days.”

-Luis G.

Meet The Creator

Haajar Jador

Haajar Jador is a certified credit specialist and funding strategist who helped entrepreneurs secure over four million dollars in capital.

After facing her own denial letters Haajar cracked the code behind lender algorithms. Her passion is simplifying finance for everyday founders so they can build generational wealth without predatory loans.

Trusted by 300+ . 100% risk-free.

Still Got Questions? No Problem!

Frequently Asked Questions

How long does it take to see results?

We’d love to have you on board! Simply hit the button below, call our team, or DM us, and someone will be in contact with you within 24 hours.

What items can you remove?

We dispute closed/negative accounts only

How Can I Improve My Score?

Start with us today! Whether it’s getting negative items removed or positive lines added, we can help!

How Long Does it Take to Fix My Credit?

Please allow 2 business days after all information has been received for us to prep and mail your disputes out to the 3 consumer reporting agencies. Once they are delivered to them, processing time starts!

The basic package includes 3 rounds (typically takes around 3 months), and the premium plan includes 6 rounds (typically around 6 months). However, the majority of our clients start seeing results in the first 90 days.

Remember, we are credit repair specialists, not magicians. We fight on your behalf, using consumer laws each month to get accounts removed. Credit repair takes patience! With that being said, there are no refunds.

How Long Until I Start Seeing Results?

You can expect to see results in at least 30 days, with it taking up to 90 days in some cases.

How Do I Get Started?

To get started, simply choose your credit repair plan, follow the onboarding instructions sent to your email, and we’ll begin disputing negative items. You’ll start seeing updates in your client portal every 35–40 days—sometimes as fast as 1–2 weeks!

Disclaimer: We Do Not Guarantee Results - Credit repair outcomes vary for each individual. Your progress depends on your specific credit history, your actions, and your commitment to the process. However, we guarantee that We will work on your credit consistently and apply proven strategies until we see measurable improvements, but the timeline and results cannot be predicted. We work , until we see results.